See This Report about Transaction Advisory Services

Rumored Buzz on Transaction Advisory Services

Table of Contents4 Easy Facts About Transaction Advisory Services ShownThe Ultimate Guide To Transaction Advisory ServicesTransaction Advisory Services - The FactsTransaction Advisory Services - QuestionsThe 10-Second Trick For Transaction Advisory Services

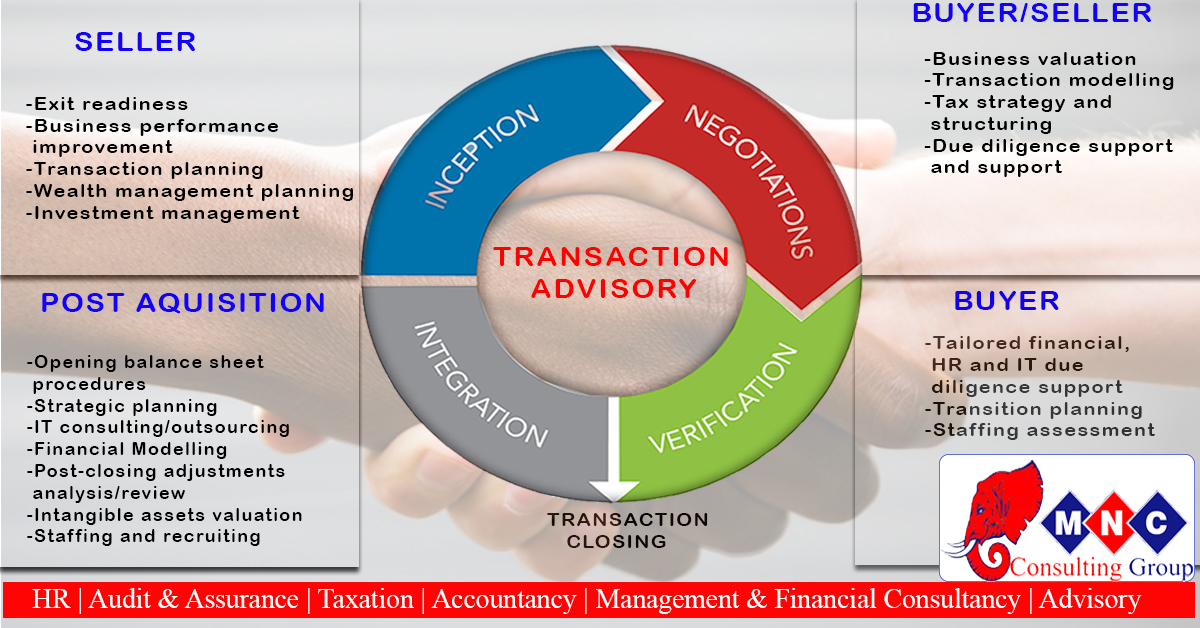

This step makes sure business looks its ideal to possible customers. Obtaining the business's value right is vital for an effective sale. Advisors utilize different techniques, like affordable capital (DCF) evaluation, comparing to similar companies, and recent purchases, to figure out the reasonable market value. This helps establish a reasonable cost and work out effectively with future buyers.Deal experts action in to aid by getting all the needed details organized, addressing concerns from buyers, and organizing visits to the organization's location. This constructs trust with buyers and maintains the sale relocating along. Getting the most effective terms is essential. Transaction advisors utilize their know-how to assist entrepreneur manage difficult arrangements, satisfy buyer assumptions, and structure bargains that match the proprietor's goals.

Meeting legal policies is critical in any type of organization sale. They aid business proprietors in planning for their next steps, whether it's retirement, starting a new venture, or managing their newfound riches.

Deal consultants bring a riches of experience and understanding, making certain that every facet of the sale is handled professionally. Through strategic preparation, evaluation, and arrangement, TAS helps company owner attain the greatest feasible sale rate. By making certain legal and governing conformity and managing due persistance along with other deal staff member, transaction advisors decrease possible dangers and obligations.

Getting My Transaction Advisory Services To Work

By comparison, Large 4 TS teams: Work with (e.g., when a possible buyer is carrying out due diligence, or when a bargain is closing and the customer needs to incorporate the business and re-value the vendor's Annual report). Are with fees that are not connected to the deal closing successfully. Make fees per involvement somewhere in the, which is less than what financial investment banks gain even on "tiny deals" (yet the collection chance is also a lot greater).

, yet they'll focus a lot more on bookkeeping and appraisal and much less on subjects like LBO modeling., and "accountant only" topics like trial balances and exactly how to stroll via occasions using debits and credit scores instead than monetary declaration adjustments.

The Only Guide to Transaction Advisory Services

that show just how both metrics have actually changed based on items, networks, and clients. to judge the precision of monitoring's previous forecasts., consisting of aging, stock by product, average degrees, and arrangements. to figure out whether they're totally fictional or rather credible. Specialists in the TS/ FDD teams may likewise speak with administration regarding whatever above, and they'll create a thorough record with their findings at the end of the procedure.

The pecking order in Deal Services varies a bit from the ones in financial investment banking and private equity jobs, and the general form appears like this: The entry-level role, where you do a great deal of information and monetary analysis (2 years for a promo from here). The following degree up; similar work, yet you get the even more fascinating bits (3 years Website for a promo).

Specifically, it's tough to get promoted beyond the Supervisor degree due to the fact that few individuals leave the job at that stage, and you require to begin revealing evidence of your capability to create revenue to development. Allow's start with the hours and way of life since those are simpler to define:. There are periodic late nights and weekend work, however absolutely nothing like the frantic nature of investment banking.

There are cost-of-living adjustments, so anticipate lower payment if you remain in a cheaper location outside major financial centers. For all settings other than Partner, the base income makes up the bulk of the total compensation; the year-end benefit may be a max of 30% of your base salary. Frequently, the very best way to increase your earnings is to switch over to a different company and work out for a greater salary and reward

Not known Facts About Transaction Advisory Services

You might enter into business development, yet financial investment banking obtains harder at this stage because you'll be over-qualified for Analyst duties. Business finance is still a choice. At this stage, you must simply stay and make a run for a Partner-level function. If you wish to leave, perhaps relocate to a client and execute their assessments and due diligence in-house.

The major problem is that due to the fact that: You typically require to sign up with another Huge 4 team, such as audit, and work there for a couple of years and after that move right into TS, job there for a few years and afterwards relocate into IB. And there's still no assurance of winning this IB duty because it depends upon your region, clients, and the hiring market at the time.

Longer-term, there is likewise some threat of and since assessing a company's historical monetary info is not specifically brain surgery. Yes, people will certainly constantly need to be included, however with even more innovative technology, lower headcounts can possibly sustain client engagements. That stated, like this the Deal Providers team beats audit in regards to pay, work, and departure opportunities.

If you liked this write-up, you may be interested in analysis.

Transaction Advisory Services Can Be Fun For Everyone

Create advanced financial structures that assist in determining the actual market price of a firm. Give advisory operate in relation to organization appraisal to aid in bargaining and rates structures. Explain the most ideal form of the offer and the kind of consideration to use (money, supply, earn out, and others).

Establish activity prepare for danger and direct exposure that have been recognized. Do combination preparation to determine the process, system, and business changes that may be needed after the bargain. Make numerical quotes of combination costs and advantages to analyze the economic rationale of combination. Establish standards for integrating divisions, technologies, and company procedures.

Identify potential decreases by reducing DPO, DIO, and DSO. Analyze the potential client base, market verticals, and sales cycle. Consider the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence provides important insights into the performance go to this web-site of the company to be gotten worrying danger analysis and worth production. Recognize short-term adjustments to finances, financial institutions, and systems.